Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

Howard & Company, CPAs, P.A.

2021 Wage Base Rises for Social Security Payroll Taxes

Solved] estion list The total wage expense for Kiln Co. was

What are FICA Taxes? 2022-2023 Rates and Instructions

Federal & Regular FICA Tax Table Maintenance (FEDM & FEDS)

Employers responsibility for FICA payroll taxes

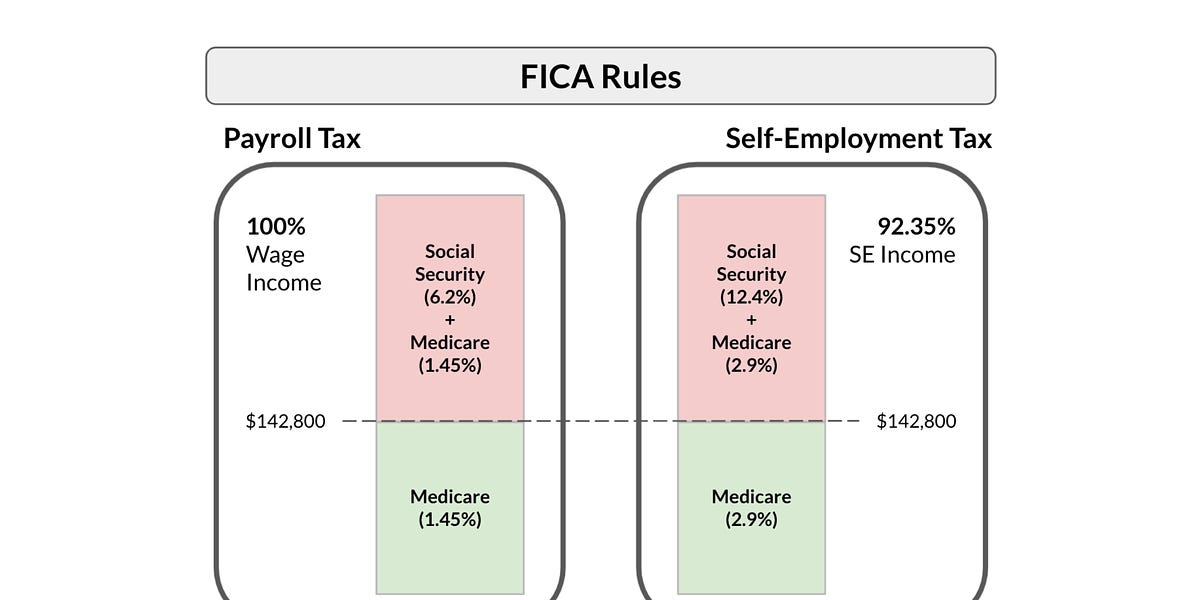

Payroll Tax - by Allen Osgood - Wealthjoy

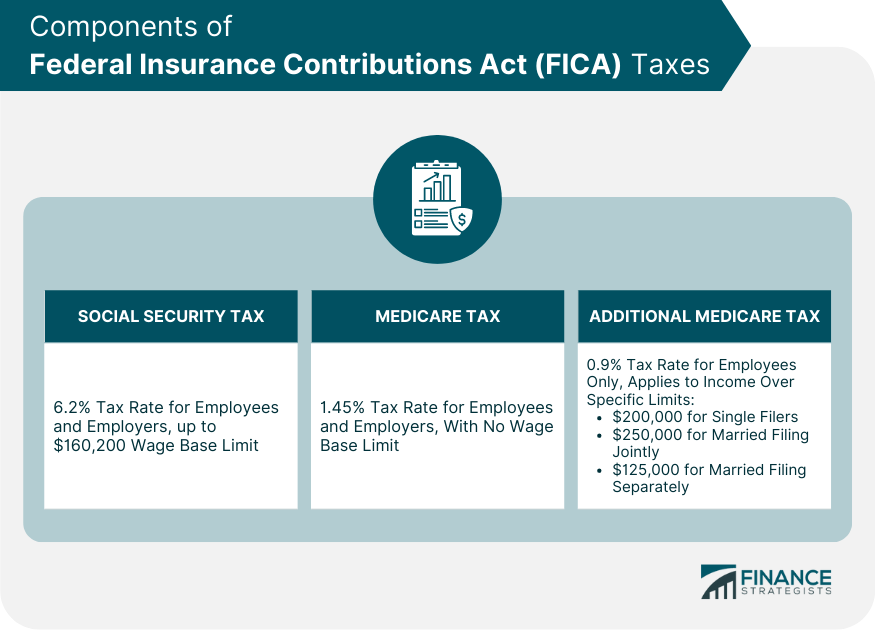

Federal Insurance Contributions Act (FICA)

Publication 505 (2023), Tax Withholding and Estimated Tax

2023 Social Security Wage Base Increases to $160,200

Payroll tax in Texas: What employers need to know

Breaking Down the Taxable Wage Base Limit: Implications for Your

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)