Residency Tie Breaker Rules & Relevance

Por um escritor misterioso

Descrição

Residency Tie Breaker Rules helps in Determining applicable tax treaties and entitlement to treaty benefits. Here are the details.

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

The Money-Saving Power of Your Library Card - WSJ

SOLVED: When determining the residency status in Canada for income tax purposes secondary residential ties that may be relevant include

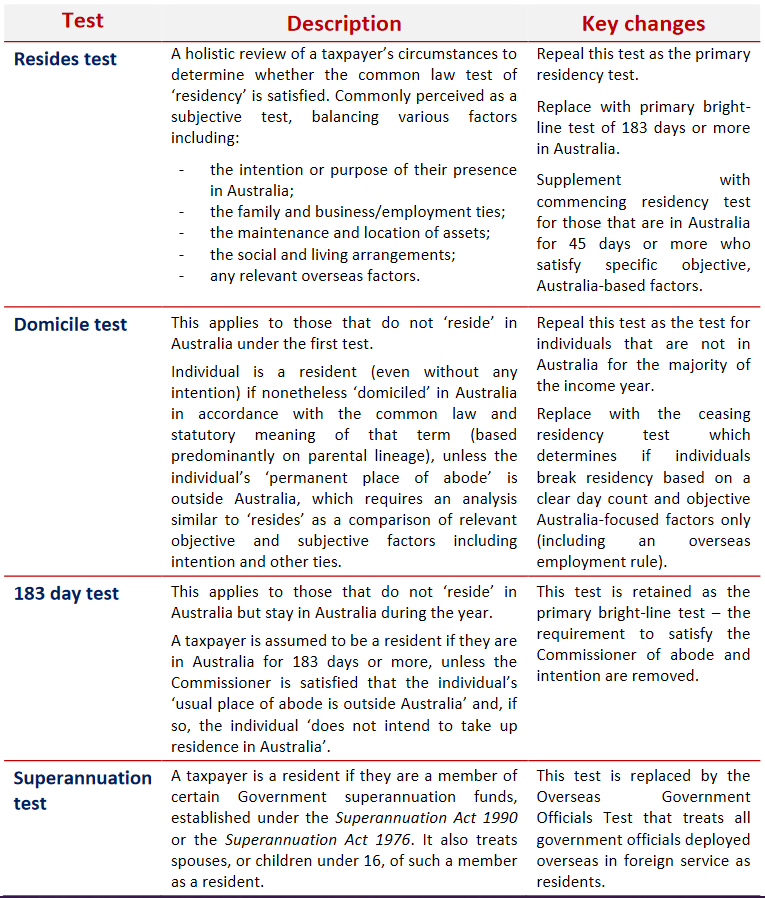

Tax residency rules to change — behind the Federal Budget proposals - TaxBanter Pty Ltd.

Understanding Tax Residency Certificate (TRC)

Who Gets to Tax You? Tie Breaker Rules in Tax Treaties

Closer Connection Test or a Treaty Tie-Breaker Provision

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

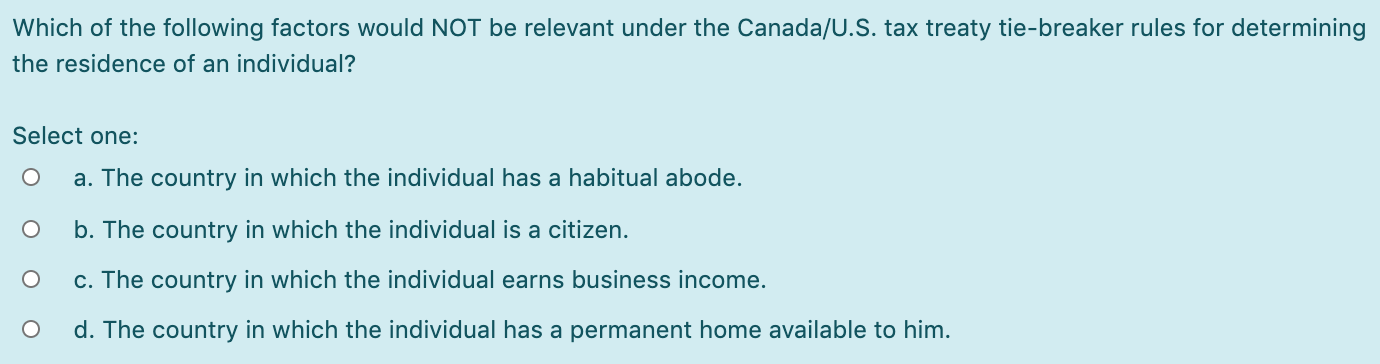

Solved Which of the following factors would NOT be relevant

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

de

por adulto (o preço varia de acordo com o tamanho do grupo)